Highlights

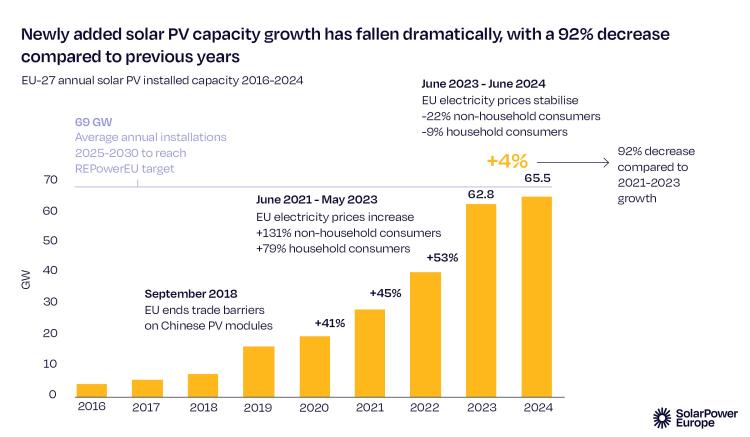

- Following several years of over 40% year-on-year growth, a new report from SolarPower Europe warns that 2024 brings only 4% annual growth to the EU solar market. This represents a 92% growth slowdown. The EU installed 66 GW of solar in 2024, inching past 2023's record of 63 GW.

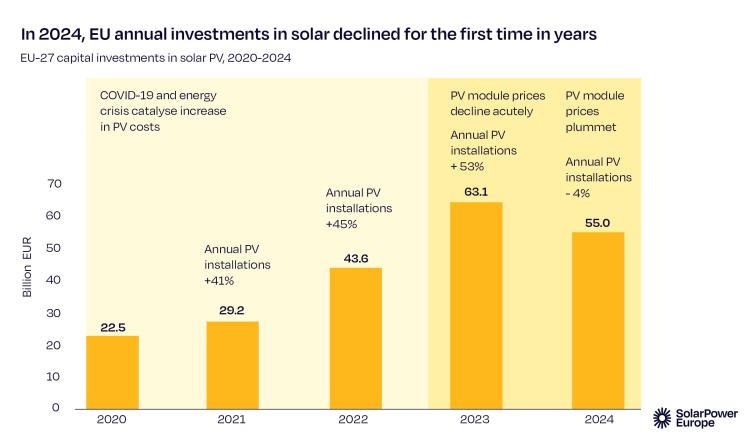

- 2024 also marks the first year where annual investment in solar installations in the EU dropped in the 2020s. A decline of 13% to 55 billion EUR is attributed to falling component prices lowering capital expenditure.

- At national-level, five of 2024's top ten solar markets installed less solar than in 2023 (Spain, Poland, Netherlands, Austria, and Hungary). The other leading markets, Germany, Italy, France, Greece, and Portugal offered modest growth, with most installing around 1 GW more than they did in 2023.

- Demand for residential rooftop solar declined in 2024, as the impact of the energy crisis fades. In 2024, new home solar installations decreased by almost 5 GW compared to last year, with 12.8 GW installed.

- While gas crisis impacts wear off for now, a slower solar forecast in the years to come is credited to wider system challenges. Sluggish electrification rates suppress demand and a lack of energy system flexibility leads to solar curtailment and negative pricing, undermining European energy security and competitiveness.

After four years of soaring growth, the EU solar sector has hit its first deployment slowdown of the 2020s, dropping from 53% growth in 2023 to 4% in 2024. This represents a 92% slowdown of solar growth.

SolarPower Europe's annual EU Market Outlook for Solar Power reveals that 65.5 GW of solar has been installed in 2024, just beating the 2023 record of 62.8 GW of new solar. The total EU solar fleet now stands at 338 GW, quadrupling from 82 GW a decade ago.

Walburga Hemetsberger, CEO at SolarPower Europe, said, "European policymakers and system operators can consider this year's report a yellow card. Slowing solar deployment means slowing the continent's goals on energy security, competitiveness and climate. Europe needs to be installing around 70 GW annually to hit its 2030 targets - we need to consider corrective action now, before it's too late."

The slowdown comes despite falling solar component prices and lower upfront costs for solar installations. Ground-mounted utility-scale solar projects saw an average cost decline of 28% in 2024. Despite the lower cost of capital, solar investment fell for the first time in the 2020s, from 63 billion in 2023 to 55 billion in 2024.