The U.S. Energy Information Administration (EIA) published its first forecasts for energy production, consumption, and prices through 2026 in its January Short-Term Energy Outlook (STEO).

Some key highlights from the January STEO include:

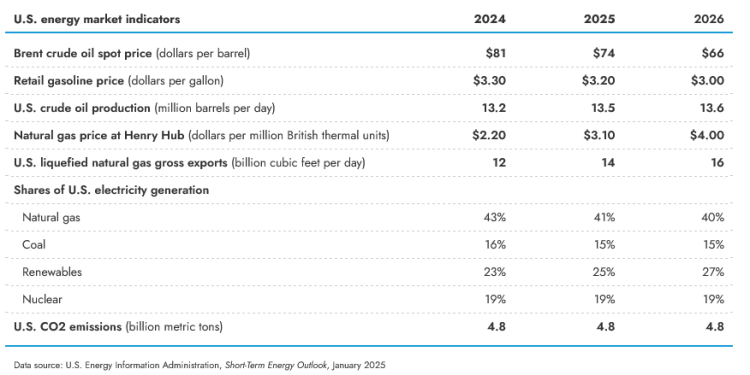

- Crude oil production: EIA expects crude oil production to increase in 2025 and 2026, both globally and in the United States. EIA estimates U.S. crude oil production averaged a record 13.2 million barrels per day in 2024 and expects it to grow to an average of 13.5 million barrels per day in 2025. U.S. production growth slows in 2026 in EIA's forecast, averaging 13.6 million barrels per day for the year.

- Global oil prices: EIA expects growth in global oil production to outpace global demand for petroleum products, which would push oil prices downward through 2026. In EIA's forecast, the Brent crude oil price will average $74 per barrel in 2025, 8% lower than in 2024, and then continues its decline to average $66 per barrel in 2026.

- Electricity demand: U.S. electricity consumption grew by 2% in 2024 after nearly two decades of relatively steady demand. EIA forecasts electricity demand to continue growing at that rate in 2025 and 2026, which would be the first three years of consecutive growth in electricity demand since 2005-07. EIA expects electricity demand to grow fastest in the industrial sector by 2% in 2025 and 3% in 2026 as new semiconductor and battery manufacturing operations come online. In the commercial sector, demand increases by 2% in both 2025 and 2026 as data-center power consumption increases.

- Renewable energy: EIA expects that for the first time, renewable energy sources will contribute one-quarter of electricity generation in the United States in 2025. Renewables contribute 27% of electricity generation in 2026 in EIA's forecasts.

- Natural gas prices: EIA expects the Henry Hub spot price to average $3.10 million British thermal units (MMBtu) in 2025 and $4.00/MMBtu in 2026, up from an all-time low average of $2.19/MMBtu in 2024. Prices increase because demand growth led by LNG exports outpaces production growth and keeps inventories at or below the 2020-2024 average for most of the next two years.

- Emissions: EIA forecasts that U.S. energy-related carbon dioxide emissions will increase slightly in 2025 and decrease slightly in 2026. EIA expects increased emissions from coal and petroleum-product consumption to drive the increases in 2025. In 2026, EIA expects that less electricity generation from natural gas and more improvements in vehicle fuel economy will be among the main contributors to a slight decrease in emissions.

The full January 2025 Short-Term Energy Outlook is available on the EIA website.

EIA Program Contact: Tim Hess, STEO@eia.gov

EIA Press Contact: Chris Higginbotham, EIAMedia@eia.gov